India – UAE Comprehensive Economic Partnership Agreement (CEPA) is expected to be a game-changer. Both these countries enjoy close trade and cultural relationships historically.

Over millennia, India and the Arab world have maintained extensive trade and cultural ties. The west coast of India, particularly the Malabar and Konkan coasts, were active trading hubs, with Arab merchants frequently visiting the region and transporting Indian goods to other markets.

With the CEPA, India-UAE’s economic relationship is expected to reach a new level and the historical relationship can reach a new peak. Indian workers and business houses have a good presence in the UAE. Similarly, there are major UAE investments in India and there is growing economic cooperation between these two nations in different sectors. The deal, signed on February 18, 2022, aims to increase bilateral trade to $100 billion in the following five years, up from the present level of $60 billion.

Comprehensive Economic Partnership Agreement

A CEPA differs from a standard FTA. CEPA are more broad and ambitious than an FTA in terms of coverage and type of obligations. While a standard FTA focuses primarily on products, a CEPA is more ambitious in terms of comprehensive coverage of several sectors, such as services, investment, competition, government procurement, disputes, and so on. Unlike an FTA, CEPA examines the regulatory elements of trade in more depth. As a result, it includes mutual recognition agreements that cover the regulatory regimes of the partners. An MRA recognizes differing regulatory regimes of partners as long as they achieve the same goal.

UAE’s non-oil products that dominated its trade with India were traditional items such as dates, pearl and fish. From India, it used to be a variety of spices such as pepper, clove, cardamom, to camphor, sandal, muslin, cotton, indigo, mango, banana and many more. With the oil discovery, petroleum products started dominating.

India: trade and economy

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

| GDP growth (annual %) | 8 | 8.3 | 6.8 | 6.5 | 4 | -7.3 |

| Inflation, consumer prices (annual %) | 4.9 | 4.9 | 3.3 | 3.9 | 3.7 | 6.6 |

| Exports of goods and services (% of GDP) | 19.8 | 19.2 | 18.8 | 19.9 | 18.4 | 18.7 |

| Exports of goods and services (annual % growth) | -5.6 | 5 | 4.6 | 12.3 | -3.3 | -4.7 |

| Imports of goods and services (annual % growth) | -5.9 | 4.4 | 17.4 | 8.6 | -0.8 | -13.6 |

| Imports of goods and services (% of GDP) | 22.1 | 20.9 | 22 | 23.7 | 21 | 19.2 |

CEPA can provide substantial momentum for expanding economic and cultural collaboration between these two countries in a variety of ways. The CEPA applies to the services sector and includes rules for mutual recognition of professional degrees, in the fields of architecture, engineering, medicine, nursing, accounting, and company secretaries. This will increase the mobility of experts and skilled workers between the two nations. Nearly 3.5 million Indians make up the UAE’s 9 million ex-pat population.

UAE: trade and economy

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

| GDP growth (annual %) | 5.1 | 3 | 2.4 | 1.2 | 3.4 | -6.1 |

| Inflation, consumer prices (annual %) | 4.1 | 1.6 | 2 | 3.1 | -1.9 | -2.1 |

| Exports of goods and services (% of GDP) | 100.9 | 101 | 99.6 | 93 | 96.8 | |

| Exports of goods and services (annual % growth) | 5.2 | 3.4 | -2.5 | 11.5 | -2.9 | |

| Imports of goods and services (annual % growth) | -5.7 | 2.7 | 3 | 10.9 | 3.6 | |

| Imports of goods and services (% of GDP) | 74.4 | 75.7 | 75.4 | 66.7 | 70.9 |

Reciprocal recognition of educational degrees between these two nations is yet another feature of the CEPA. Indian health care professionals, notably nurses, make up a sizable proportion of the workforce in the UAE and elsewhere. IT and ITES and the knowledge economy focused on special economic zones would find it easier to hire Indian software and technology specialists. It also opens up avenues of collaboration for start-ups in the both the countries, as well as more collaboration and partnership in new & advanced technology, research and in industry 4.0.

CEPA also includes 11 service sectors and over 100 sub-sectors, including, among others, business services, telecommunications, construction, education, tourism, nursing, and finance. The agreement covers a wide range of topics, including government procurement, digital trade, and intellectual property rights. To preserve domestic producers’ interests, India has excluded dairy, fruit, cereals, vegetables, tea, coffee, tobacco, dyes, soaps, footwear, petroleum, tyres, toys, aluminium scrap, copper, and processed marble from the trade deal. The trade agreement also includes a permanent safeguard mechanism that will protect both nations’ exporters and firms from any undue increase in the volume of any product. However, the agreement is subject to strict origin criteria.

As per the CEPA, medicines or medical items licensed by developed nations would be granted market access and regulatory clearance in a timely way in order to be marketed in the UAE. Apart from pharmaceuticals, medical devices companies are also expected to benefit from the deal and market access. As per the deal pharmaceutical companies will now get automatic registration and market authorisation of Indian generic formulations in just 90 days. India is the world’s largest supplier of generic medications, accounting for 20% of the worldwide supply by volume. The agreement will also provide Indian firms, especially the pharmaceutical industry, more access to the much bigger Arab and African markets.

To prevent channelling products made in foreign nations to India via the UAE, most commodities must have at least 40% value addition. For the first time in a trade agreement, the CEPA provides for the automatic registration and marketing authorization of Indian generic pharmaceuticals within 90 days after approval in any developed country. India has granted tax discounts on gold imported from the UAE, while Indian exporters would get duty-free access to the UAE jewellery market. This is significant since the two countries account for over 16% of worldwide commerce in diamonds, gold, and jewellery.

India exports a wide range of products to UAE: Precious Metals, Stones, Gems & Jewellery, Minerals, Food Commodities (Cereals, Sugar, Fruits & Vegetables, Tea, Meat, and Seafood), Textiles (Garments, Apparel, Synthetic fibre, Cotton, Yarn), Engineering & Machinery Products, and Chemicals are India’s primary export items to the UAE.

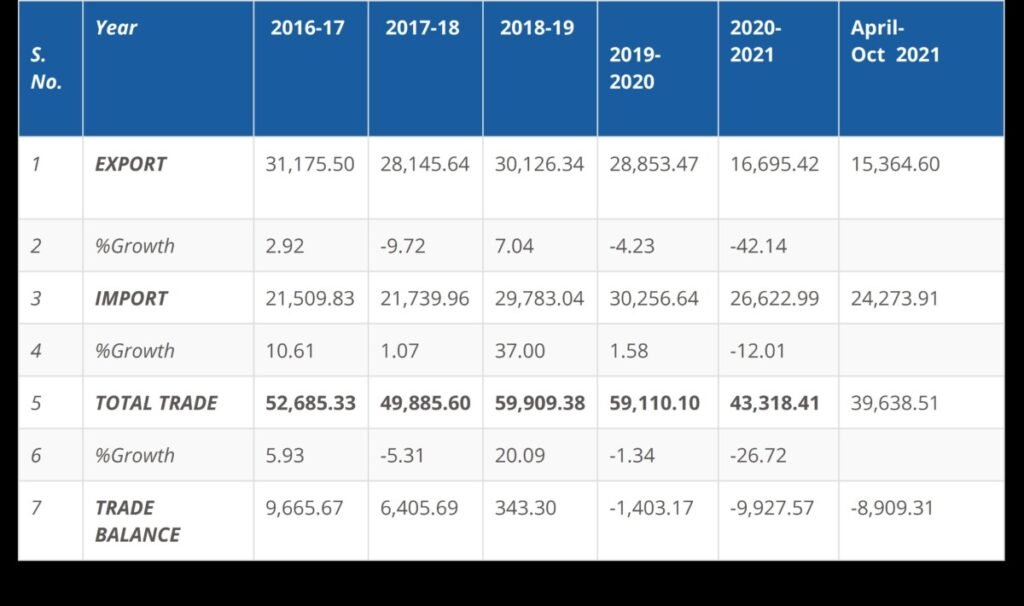

India-UAE bilateral trade 2016-17 to 2020-21

Value in US$ Million:

Source : DGCI&S, Kolkata ; Indian Embassey UAE

Petroleum and Petroleum Products, Precious Metals, Stones, Gems & Jewellery, Minerals, Chemicals, Wood & Wood Products are India’s key imports from the UAE. In 2019-20, India bought 21.83 MMT (US$ 10,927.52 Million) of crude oil from the UAE.

The UAE’s investment in India is expected to be approximately US $ 17-18 billion, with FDI accounting for US 11.67 billion and portfolio investment accounting for the rest. In terms of FDI, the UAE ranks ninth in India. During the fiscal year 2020-21, the UAE sovereign wealth funds invested more than $4.12 billion in India. The UAE’s investments in India are primarily concentrated in five sectors: services (15.78 %), sea transportation (8.80 per cent), power (8.34 %), construction (infrastructure) activities (7.15 %), and construction development (townships, housing, built-up infrastructure, and construction-development projects) (7.08 %).

To conclude, the India-UAE CEPA signed in February 2022 is indeed a major development not just in terms of the boost that it can give to India’s relationship with the middle east and Africa region, but as expected it has spiralled off many ongoing and on-hold negotiations to their logical conclusion. With more FTA and CEPAs world gets more integrated and there will be more and more collaboration between small and medium businesses and there will be enhanced prosperity.

Author Profile

-

Columnist|Entrepreneur|Development Professional. Believes in freedom and human potential. Writes on #Economy #Enterprise #Entrepreneurship #Business #SustainableDevelopment

He can be reached at caushie@gmail.comLinkedin: https://www.linkedin.com/in/caushie/

Twitter: https://twitter.com/pkoshyin

Latest entries

FEATURED25 November 2024Rethinking Work Hours: The Case for Balance in SME Growth Strategies?

FEATURED25 November 2024Rethinking Work Hours: The Case for Balance in SME Growth Strategies? AI25 November 2024Microsoft’s ‘Zero Day Quest’: A $4 Million Challenge to Revolutionize AI and Cloud Security!

AI25 November 2024Microsoft’s ‘Zero Day Quest’: A $4 Million Challenge to Revolutionize AI and Cloud Security! FEATURED5 November 2024Collaboration Agreement Signed Between Mubadala Energy and Perusahaan Listrik Negara (PLN) to Explore Harnessing Natural Gas Discoveries

FEATURED5 November 2024Collaboration Agreement Signed Between Mubadala Energy and Perusahaan Listrik Negara (PLN) to Explore Harnessing Natural Gas DiscoveriesFEATURED23 October 2024Resilient Trade Amid Global Uncertainty: How Intra-BRICS Commerce is Shaping a New Economic Order